Has cyber insurance lost the war with AI?

The question for our industry is no longer whether AI will be utilized by adversaries, but whether the insurance model can evolve quickly enough to remain a viable backstop for the digital economy, writes Guy Simkin, co-founder and CEO at Cyber Insurance Academy

Latest updates

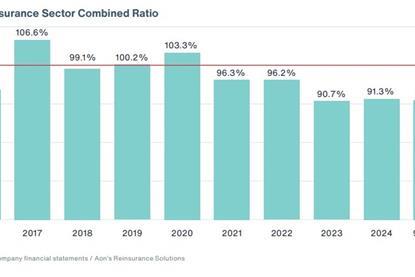

Moody’s holds stable outlook for global P&C as profits and capital hold firm

Global property and casualty insurers are set to maintain solid profitability and strong capital positions through 2026, despite subdued economic growth and persistent casualty and catastrophe loss trends, according to a new sector outlook from Moody’s Ratings.

LSM appoints Saillen as European CUO

New European chief underwriter at Liberty Specialty Markets part of insurer’s Invest in Europe 2030 strategy

Blenheim Partnerships launches trade credit MGA under Parker

New credit MGA launches with capacity from Blenheim Underwriting and other Lloyd’s market carriers.

TFP’s Imala Re appoints Herrera as deputy CUO

MGA Imala Re began underwriting from 1 January through The Fidelis Partnership’s Pine Walk platform.

Casualty reinsurance at 1/1: capital returns, but discipline holds

January renewals marked a turning point for casualty reinsurance, though not in the same abrupt fashion seen in property catastrophe business, according to broker reports.

Record capital fuels buyer leverage and growth options at 1.1 renewals, Aon finds

Competition intensified at the January 2026 renewals, with double-digit price reductions in property and new options opening for insurers to redeploy savings into earnings protection and growth, according to the re/insurance broker’s renewals report.

News

Howden strengthens transaction liability platform with Atlantic Group acquisition

Reinsurance buyers find choice and flexibility at 1.1 as capacity expands, says Gallagher Re

Howden heralds ‘re-balancing’ as rates fall to pre-hard-market levels

Reinsurer capital deployment drives 1/1 softening – Guy Carpenter

- Previous

- Next

- Previous

- Next

- Previous

- Next